The Central Bank of Nigeria (CBN) has issued new and tougher rules for agent banking and Point-of-Sale (POS) operators, introducing expanded geo-tagging responsibilities, stricter eligibility conditions, and tighter compliance standards to improve transparency and security in Nigeria’s financial services sector.

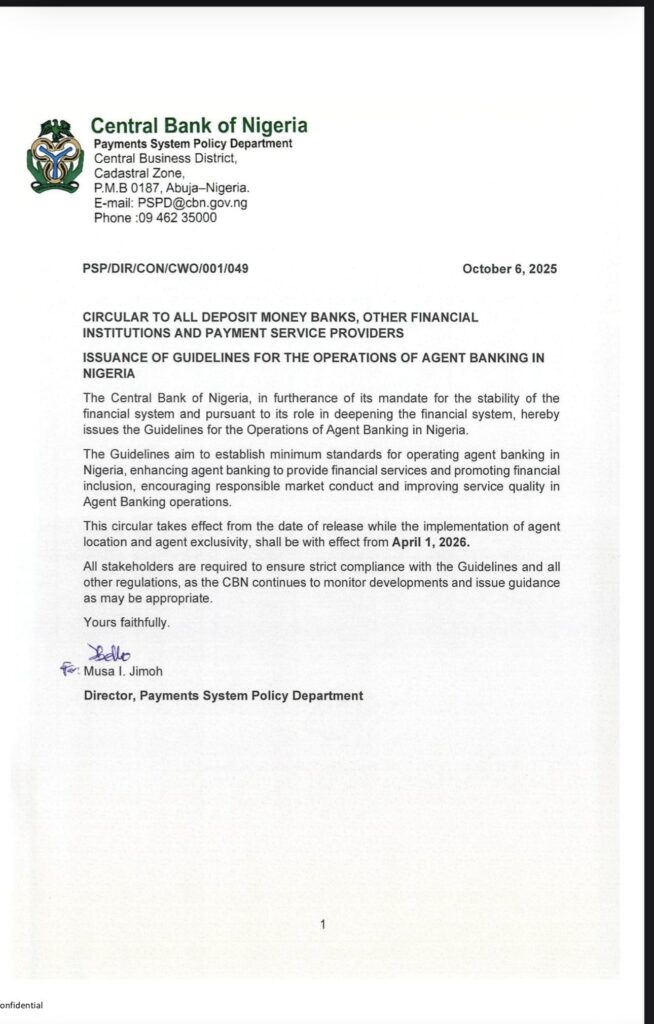

The new directives were contained in Section 9.4 of the Guidelines for Agent Banking Operations in Nigeria, released on Monday by the Payments System Policy Department of the CBN.

According to the guidelines, the CBN has expanded the roles of Payment Terminal Service Aggregators (PTSAs) — the entities responsible for managing and regulating POS terminals nationwide. The apex bank named the Nigeria Inter-Bank Settlement System (NIBSS) Plc and Unified Payment Services Limited (UPSL) as licensed PTSAs.

The document, signed by Musa Jimoh, Director of the Payments System Policy Department, officially recognizes PTSAs as key stakeholders in the agent banking ecosystem.

Expanded Responsibilities of PTSAs

The new framework mandates PTSAs to:

- Register all POS terminals deployed for agent banking services;

- Geo-fence or tag POS terminals to ensure operation within approved agent locations only;

- Integrate their systems with the CBN Automated Regulatory Data Solutions (CARDS) platform for unique agent identification;

- Submit monthly reports of transactions to the CBN;

- Provide detailed returns on the number of POS terminals and Super Agents registered within their assigned regions.

According to the CBN, these responsibilities aim to strengthen oversight, prevent fraud, and enhance transparency in Nigeria’s fast-growing POS and digital banking ecosystem.

Who Cannot Operate as Agents

In addition to operational reforms, the CBN introduced a list of disqualifying conditions under Section 7.2 of the new guidelines.

Individuals or entities barred from participating in agent banking include:

- Persons or companies with non-performing loans within the past 12 months;

- Anyone who has been declared bankrupt or convicted of fraud, dishonesty, or related offenses;

- Individuals or firms whose Bank Verification Numbers (BVN) are watch-listed or blacklisted;

- Entities that have violated CBN guidelines or Nigerian laws related to banking and financial operations.

The apex bank also emphasized that financial institutions must carry out due diligence checks before appointing agents — including verifying credit histories through licensed credit bureaus.

CBN’s Goal: Cleaner, More Secure Agent Banking

The CBN said the revised rules were introduced to sanitize the agent banking industry, curb financial crimes, and ensure that only credible, law-abiding individuals and businesses operate within the space.

The reforms also align with the CBN’s commitment to financial inclusion, consumer protection, and the Renewed Hope Agenda of President Bola Ahmed Tinubu, which prioritizes a transparent and technology-driven financial system.