Asaba, Delta State — November 27, 2025: Nigeria’s ongoing tax reforms took centre stage on Thursday as experts, legal professionals, academics, and media practitioners dissected the newly enacted 2025 Tax Law at the 6th Annual Lecture Series of the Delta Online Publishers Forum (DOPF), held at David’s Event Centre, Asaba.

The event, themed “Nigeria’s New Tax Law: Implications and Opportunities for Businesses and Society,” opened with a strong call for accountability, infrastructural development, and improved security as the country prepares to implement the new law on January 1, 2026.

“Tax Must Translate to Development” — DOPF Chairman

In his welcome address, Mr Enebeli Emmanuel, Chairman of the Delta Online Publishers Forum, stated that the new tax structure presents a rare opportunity for the government to regain public trust—but only if citizens see tangible improvements tied to the revenue’s use.

He explained that Nigerians are no longer satisfied with mere tax compliance; they want clear and measurable progress in infrastructure, safety, and service delivery.

Emmanuel commended the Delta State Government for projects such as the Ughelli–Kwale–Asaba Road, describing it as proof of how public spending can boost economic activity.

However, he expressed worry over neglected federal roads, especially the Agbor–Asaba–Onitsha Road, which he said continues to punish commuters and disrupt commerce.

He also highlighted the abandoned Agbor–Obiaruku–Abraka–Eku–Sapele Road, calling it a major economic corridor that the government must urgently revive.

On security, he applauded the Delta State Security Trust Fund, urging the governor to quickly sign the Delta State Community Security Bill to strengthen local policing and investor confidence.

Guest Lecture: New Tax Law Designed to Stabilise Nigeria’s Economy — Dr Emudainohwo

Delivering the keynote lecture, Dr Ochuko Emudainohwo, FCA, Associate Professor of Accounting at Dennis Osadebay University, said the 2025 tax law represents one of Nigeria’s most strategic economic decisions in decades.

He outlined factors that necessitated the reform: Declining oil revenue, increasing population pressure on public services, Consequences of COVID-19, and Persistent revenue leakages.

He described the new framework as “pro-people”, stressing that it consolidates income and company taxes, simplifies compliance, and reduces corruption.

A major highlight, he said, is the exemption of companies earning less than ₦50 million annually from capital-based and company income taxes—a move he believes will strengthen small businesses and encourage innovation.

He also praised the law’s push for digital tax systems, saying they will improve transparency and plug revenue loopholes.

Governor Oborevwori: Citizens Must Care About How Government Spends Their Money

Representing the Delta State Governor, the Commissioner for Works (Rural Roads) and Public Information, Hon. Charles Aniagemphasised that taxation naturally increases citizen awareness of public spending.

He argued that the new tax law places greater responsibility on the government to be transparent, just as taxpayers are accountable for their own financial decisions.

Aniagwu advised that the lecture’s recommendations be forwarded to the Presidential Committee on Tax Reform to strengthen ongoing sensitisation efforts.

He also clarified that cooperative societies making profits must pay tax, saying no organisation should hide under cooperative structures to evade obligations.

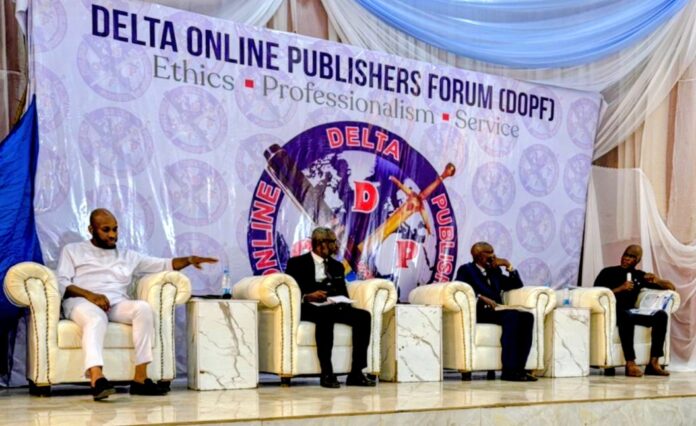

The highlight of the event is a high-level panel session moderated by Mr Lawrence Okpewho, a veteran broadcaster and media manager, who helped break down the law’s complexities into practical, citizen-friendly insights.

The panel featured:

- Martins Onyem Aghaobodo, Esq, a Legal Practitioner & Head of Chambers, Oyem M. Aghaobodo & Associates

Aghaobodo explained the legal responsibilities of taxpayers and the government under the new law.

He stressed the need for public enlightenment to help citizens understand their rights regarding taxation, including fair assessment, appeals, and protection from arbitrary penalties. - Victor Fegor Origbo, a Professional Accountant, Academic & Consultant. Origbo discussed the economic impact of the new law, especially on SMEs.

He noted that tax exemptions and streamlined procedures will reduce operational burdens and strengthen financial planning for small and medium-scale businesses. - Barr. Ikpesu Gideon Jade, a Solicitor & Advocate of the Supreme Court of Nigeria. Jade highlighted the constitutional foundation of the 2025 tax reforms, adding that improved harmonisation of taxes across federal and state agencies will reduce duplication, multiple taxation, and confusion for business operators.

- Moderator: Mr Lawrence Okpewho, a Veteran Nigerian Broadcaster & Media Manager. Okpewho guided the discussion to ensure clarity, stressing the need to simplify tax communication so ordinary Nigerians can understand how the new law affects their daily lives.

Closing the event, Mr Emmanuel said insights from the keynote lecture and panel discussions will be compiled and shared with policymakers.

“On behalf of the Delta Online Publishers Forum,” he said, “we remain committed to expanding public understanding of Nigeria’s new tax direction and how it can reshape the country’s economic future.”