As Nigeria continues to search for firmer economic footing, a fresh voice has stepped into the national conversation—Dr. Ochuko Emudainohwo—who believes the newly enacted 2025 tax law may be the turning point the country has waited for, offering a clearer path to inclusive growth and fiscal stability.

Dr. Emudainohwo urged businesses, policymakers, and citizens to align with the reform, noting that national progress depends on a collective commitment to transparency, accountability, and a sustainable revenue culture.

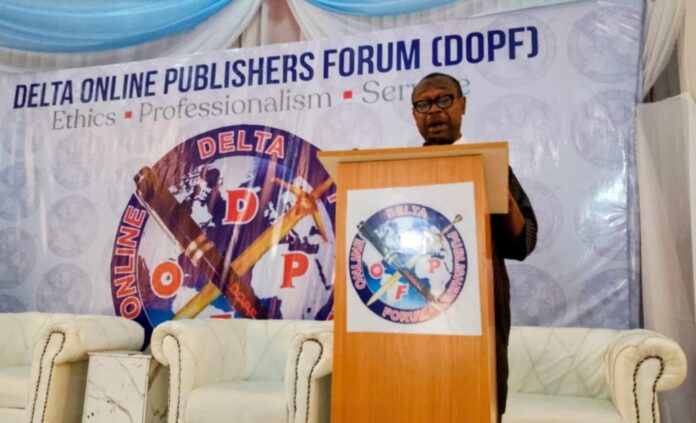

The Associate Professor of Accounting at Dennis Osadebay University, Asaba, spoke as Guest Speaker at the Delta Online Publishers Forum (DOPF) 2025 Lecture Series held in Asaba. Addressing the theme, “Nigeria’s New Tax Law: Implications and Opportunities for Businesses and Society,” he unpacked the structure, purpose, and expected benefits of the tax overhaul introduced under President Bola Ahmed Tinubu.

He noted that taxation has always been central to national development but stressed that to understand the urgency of the 2025 tax law, Nigerians must first acknowledge the fragile realities that preceded it.

These include a drastic decline in oil revenue, a growing population placing heavy strain on public services, and the lingering economic shocks of COVID-19, which exposed the vulnerability of the country’s revenue system.

According to him, these pressures compelled the federal government to rethink its fiscal foundation and adopt a more sustainable and inclusive approach to public finance.

At the centre of the new legislation, he said, is the goal of breaking Nigeria’s long-standing dependence on oil. He explained that the 2025 tax framework consolidates income and company taxes into a single tax net, simplifying compliance and minimizing bureaucratic hurdles.

Describing the reform as inherently “pro-people,” Dr. Emudainohwo said it was crafted not only to increase government revenue but to stimulate economic expansion across multiple sectors.

He pointed to one major shift in favour of small businesses:

“The law supports Small and Medium-Scale Enterprises (SMEs). Companies with an annual turnover of less than N50 million are now exempted from capital-based taxes and company income taxes.”

He argued that this exemption will ease pressure on small businesses, boost innovation, and encourage more young Nigerians to venture into entrepreneurship.

Beyond revenue adjustments, he highlighted the law’s emphasis on transparency and modernization. Strengthening digital tax platforms, he said, will improve accountability, streamline operations, and reduce leakages that have historically undermined public revenue.

Dr. Emudainohwo concluded that the 2025 tax reform signals a shift toward a more efficient, technology-driven tax system aligned with global standards—one capable of supporting Nigeria’s long-term economic transformation.